Finding the Right Mining Stock is Like Striking Gold...

I’m not saying we’ve struck gold just yet, but we have found a company that checks all of our boxes!

Power Nickel could be the next big mover in the junior mining space.

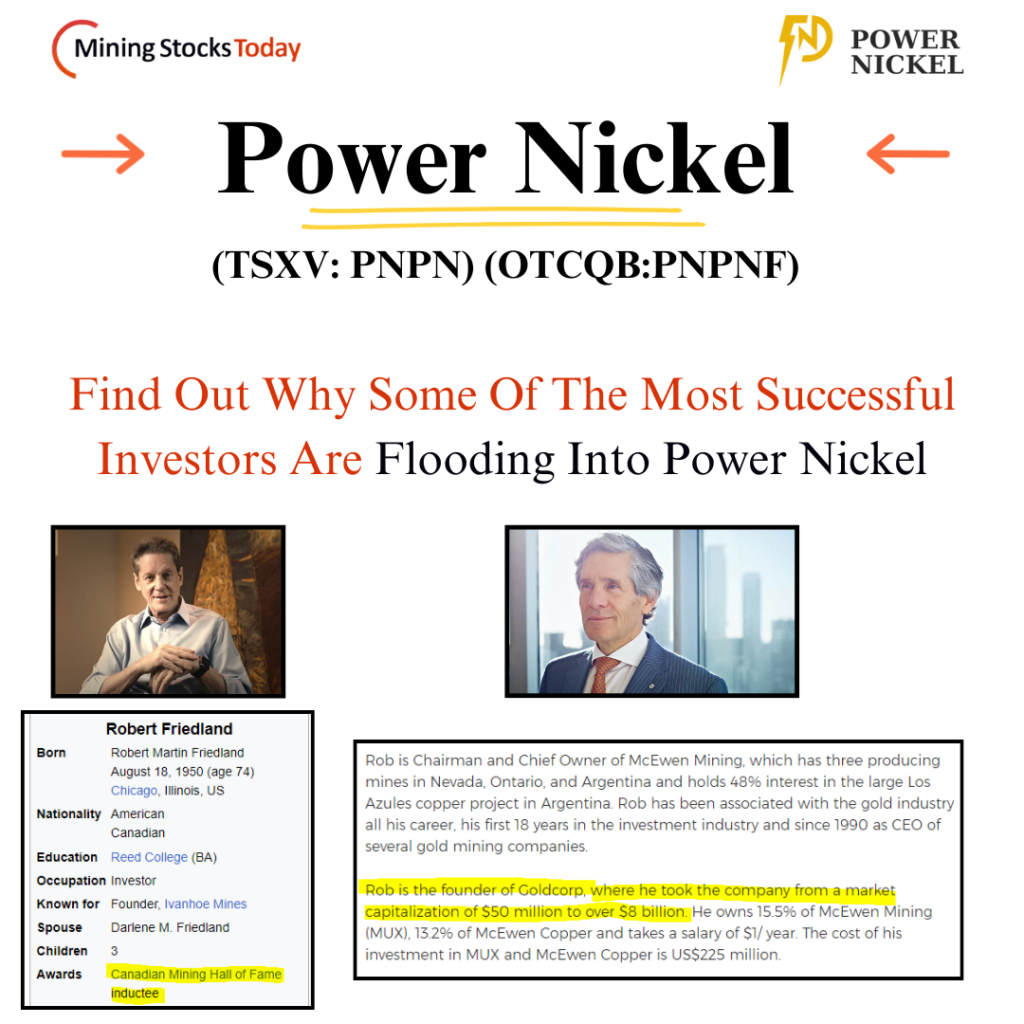

Power Nickel Uncovers Massive Polymetallic Zone, Attracting Major Investors Like Robert Friedland and Rob McEwen!

👇👇👇

✔Are You A Investor Seeking High Growth Stocks?

✔Are You A Investor Interested In A Stock Under $1 With Multiple Billionaires Involved?

YES? YES?

Then...Listen Carefully

Recent Winners in the

Mining Industry

Great Bear Resources (GBR.V)

3,500% Return

From CAD 0.50 to over CAD 18.00 in just two years after high-grade discoveries at its Dixie Project in Ontario, Canada.

SilverCrest Metals (SIL.V)

760% Return

Climbed from CAD 1.50 to over CAD 13.00 in two years on impressive results from the Las Chispas Project in Sonora, Mexico.

K92 Mining (KNT.V)

1,700% Return

Surged from under CAD 0.50 to over CAD 9.00, driven by successful ramp-up and exploration at the Kainantu Gold Mine in Papua New Guinea.

Now, all eyes are on Power Nickel, the most compelling story in the junior mining sector today.

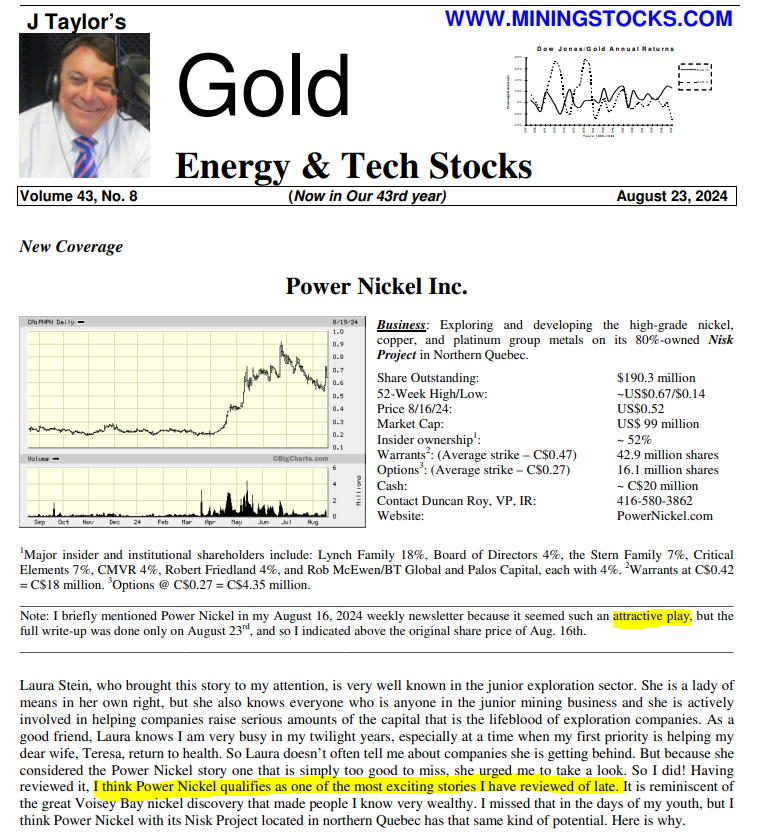

Jay Taylor, a former banker and top value investor whose picks have outperformed the S&P 500 since 2000, recently called Power Nickel “one of the most exciting stories.”

And he’s not alone. All-star investors have backed Power Nickel with $20 million in funding. Among them is Rob McEwen, the founder of Goldcorp, who grew the company from a $50 million market cap to over $8 billion. His investment in Power Nickel signals massive potential.

Power Nickel: Major Upside Potential with 54% Target Increase - Expert Analysts Weigh In!

✅”I think Power Nickel qualifies as one of the most exciting stories I have reviewed of late” J Talor, MiningStocks.com

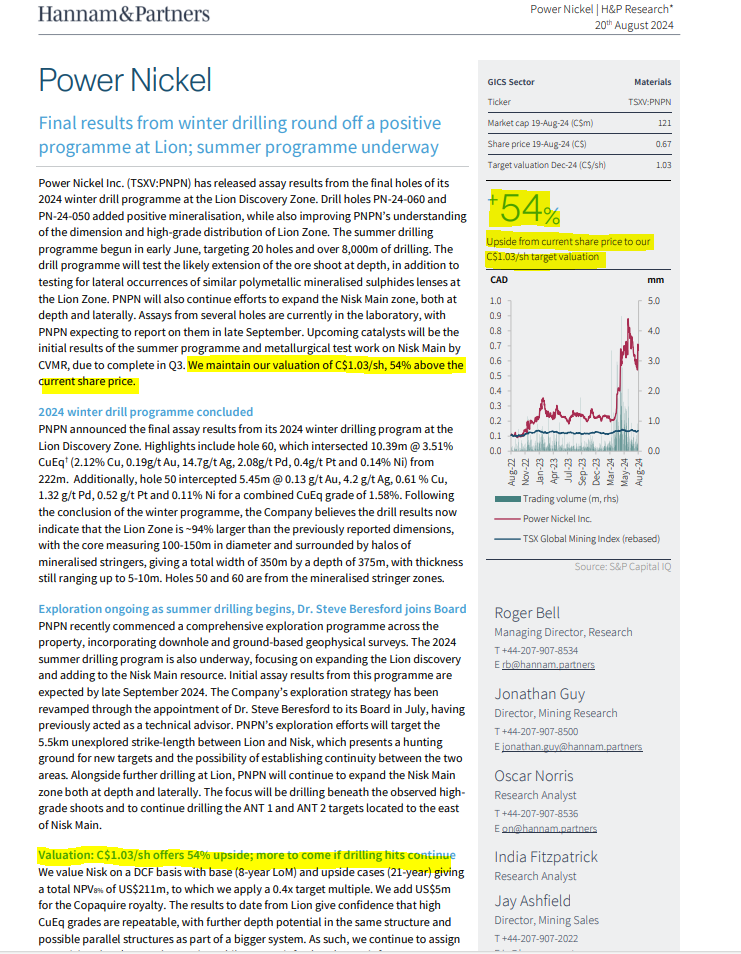

✅”We maintain our valuation of C$1.03/sh, 54% above the current share price.” Hannam & Partners

Why are industry giants turning their focus to Power Nickel?

Power Nickel Checks All the Boxes:

Financially secure for the next 18 months, allowing Power Nickel to advance its ambitious plans without immediate funding needs.

A large-scale program targeting high-grade polymetallic zones is already in progress, increasing the potential for significant discoveries.

Recent findings of nickel-copper-cobalt-PGE deposits offer multiple catalysts for near-term growth.

Trading under $1, Power Nickel presents a unique chance for substantial upside based on its promising discoveries.

Backed by some of the biggest names in mining, bringing credibility and confidence to the project’s future.

Hannan & Partners recently reaffirmed their target price for Power Nickel at C$1.03 per share, projecting a 53% increase from the current market price.

The Nisk Project: A Game-Changer

Located in Quebec, Canada, the Nisk Project features critical battery metals - Nickel, Copper, Cobalt, Palladium, and Platinum - essential for electric vehicles and green tech.

Positioned in a politically stable region with strong government and First Nation partnerships, and significant infrastructure benefits, including proximity to major highways, towns, and low-carbon hydropower.

An indicated resource of 5.43 million tonnes grading 1.05% NiEq, with further exploration pointing to significant upside potential.

Aiming to be the world’s first carbon-neutral nickel mine, aligning with market demand for sustainable mining.

Supported by industry leaders like Robert Friedland and Rob McEwen, who have invested $20 million to accelerate development.

The Nisk Project boasts a unique polymetallic deposit that includes not just nickel and copper, but also cobalt, palladium, and platinum.

Power Nickel's Game-Changing Exploration Update

Hannam & Partners sees 54% Upside With C$1.03 Price Target

“Power Nickel has shown substantial progress with its recent drilling programs, revealing the Lion Zone to be approximately 94% larger than previously reported. With an ambitious summer program underway and several key results expected soon, the company stands poised for significant growth. Analysts have assigned a target valuation of CAD 1.03 per share — a potential 54% increase from the current price. With ongoing exploration, strong leadership, and strategic catalysts on the horizon, Power Nickel continues to check all the boxes for being the next big mover in the junior mining sector.”

Based on the recent report from H&P Research, there are several key developments and insights that make Power Nickel a compelling opportunity in the junior mining sector:

- Positive Winter Drill Results at Lion Discovery Zone: The final assay results from Power Nickel’s 2024 winter drilling program at the Lion Discovery Zone showed significant positive outcomes. Drill holes PN-24-060 and PN-24-050 have added substantial mineralization, improving the understanding of the dimension and high-grade distribution of the Lion Zone. Notably, hole 60 intersected 10.39 meters at 3.51% Copper Equivalent (CuEq), including 2.12% copper, 0.19 g/t gold, and other valuable metals.

- Expansion Potential with Summer Drilling Program: The summer drilling program, which began in early June 2024, is ambitious, targeting 20 holes and over 8,000 meters of drilling. This program aims to test the extension of the ore shoot at depth and explore lateral occurrences of similar polymetallic mineralized sulphide lenses at the Lion Zone. Additionally, Power Nickel plans to expand the Nisk Main zone, both at depth and laterally.

- Valuation and Upside Potential: H&P Research maintains a target valuation of CAD 1.03 per share, which represents a 54% upside from the current share price. This valuation reflects confidence in the repeatability of high Copper Equivalent grades at depth and the potential for discovering additional parallel structures within a larger system.

- Key Upcoming Catalysts: Several catalysts are expected to drive value in the near term, including the initial results of the summer drilling program and the completion of metallurgical test work on the Nisk Main by CVMR, anticipated in Q3 2024. These results will provide more clarity on the mineral resources and could significantly enhance Power Nickel’s valuation if successful.

- Strategic Appointments and Expanded Exploration Focus: The addition of Dr. Steve Beresford to the Board of Directors as of July 2024 strengthens the technical leadership of Power Nickel. His expertise is expected to enhance exploration efforts, particularly targeting the 5.5 km unexplored strike-length between the Lion and Nisk zones, which presents significant opportunities for new discoveries and resource expansion.

Power Nickel: Charting the Path to Growth - A Wall Street Trader's Insight

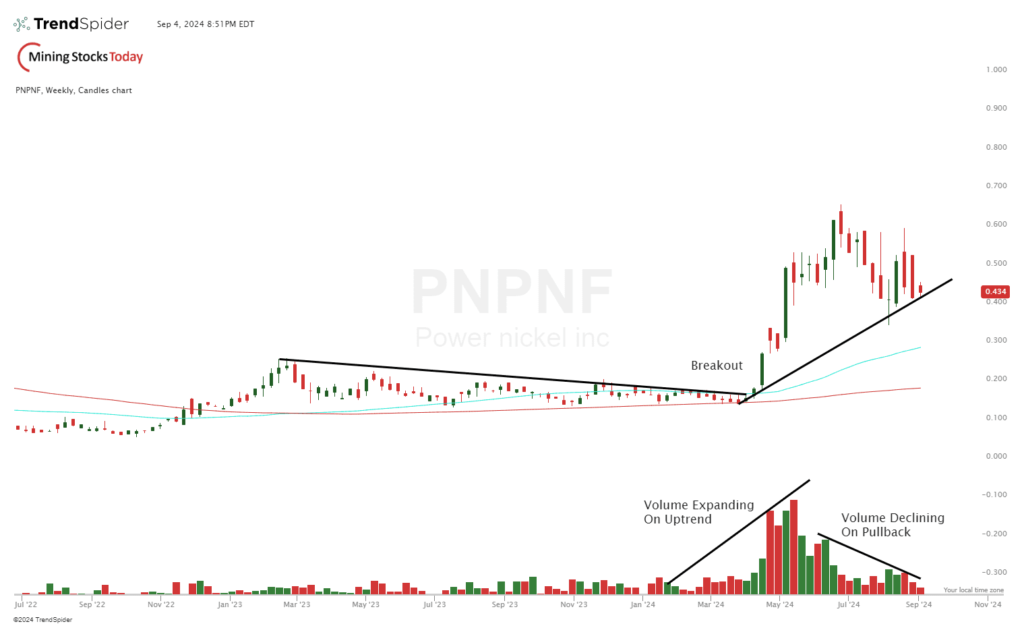

As we examine the chart of Power Nickel, trading under the ticker PNPNF on the OTC market and PNPN on the Toronto Stock Exchange, a few key points stand out.

The stock began a significant upward move in April, rallying from around 16 cents to approximately 64 cents. Since then, it has experienced a pullback on declining volume, indicating a lack of selling pressure. This light volume during the pullback is a healthy sign, suggesting the stock is consolidating and building strength for a potential next leg up.

Currently, Power Nickel is trading above its long-term moving averages, reinforcing the presence of a solid uptrend.

The bottom line: Power Nickel presents a compelling growth opportunity with backing from household-name investors and billionaires. From a technical perspective, there are no red flags; instead, we see strong bullish momentum that could fuel the stock’s next move higher in our opinion.

Unlock Your Free Mining Masterclass For Traders and Investors Today!

Module 1

Introduction Into Mining For Traders and Investors

Module 2

The Life Cycle Of A Mining Company

Module 3

Key Metrics and Financial Indicators in Mining

Module 4

Risk Factors and Red Flags in Mining Investments

Module 5

How to Build a Mining Stock Portfolio

Module 6

Bonus: Case Study On Power Nickel

SMS Sign-Up Form

Disclaimer for MiningStocksToday.com

Effective Date: September 5, 2024

MiningStocksToday.com is a financial information website that provides news, analysis, and marketing services related to publicly traded companies. By using this website, you agree to the terms and conditions outlined in this Disclaimer.

Disclosure in Accordance with Toronto Stock Exchange Rules

This publication has been compensated by Power Nickel and other companies to disseminate information. We adhere to the disclosure rules set forth by the Toronto Stock Exchange (TSX) and other regulatory bodies, ensuring that all compensated content is clearly labeled and disclosed to our readers.

Forward-Looking Statements

This website includes forward-looking statements about future anticipated plans, performance, and development of the companies we cover. Any statements on this website that are not statements of historical fact should be considered forward-looking statements. These statements generally can be identified by words such as “believes,” “expects,” “anticipates,” “foresees,” “forecasts,” “estimates,” “intends,” and similar expressions. All such forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those expressed or implied by the forward-looking statements.

Educational and Informational Purposes Only; Not Investment Advice

All content on MiningStocksToday.com, including articles, posts, newsletters, and comments, is provided for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or relied upon as personalized investment advice. MiningStocksToday.com recommends you consult a licensed or registered professional before making any investment decision, as investments can be fully lost at any time.

No Guarantees

MiningStocksToday.com offers no guarantees and provides forward-looking statements with the sole purpose of personal enjoyment and entertainment. If at any time a security discussed on MiningStocksToday.com is purchased, you agree to hold MiningStocksToday.com harmless and liability-free. There are no guarantees in participating in financial markets, and investments can be lost entirely at any time.

No Investment Advisor or Registered Broker

Neither MiningStocksToday.com nor any of its owners or employees are registered as a securities broker-dealer, investment advisor (IA), or IA representative with any securities regulatory authority. MiningStocksToday.com does not give out investment advice, and all content is intended solely for informational and educational purposes.

Risks and Warnings

The content published on this website is intended for reference purposes only and is neither an offer nor a solicitation to purchase or sell any security or instrument or to participate in any particular trading strategy. Users of this website agree that they are not using any content of this website in connection with an investment decision. Persons should consult with their financial advisors before making any investment decisions.

OTC Risk Warnings: Because many securities traded Over-The-Counter (OTC) are relatively illiquid, an investment in an OTC security involves a high degree of risk. It should be noted that the liquidation of a position in an OTC security may not be possible within a reasonable period of time. Dependable information regarding issuers of OTC securities may not be available, making it difficult to properly value an investment.

Consent

By using this website and its services, or by providing us with information about yourself, you consent to the collection, storage, and use of this information. If you do not agree to these terms, please exit the website now.

Safe Harbor Statement

Forward-looking statements on this website are subject to risks and uncertainties that could cause actual results to differ materially. The Publisher does not guarantee the accuracy of any forward-looking statements and assumes no responsibility for any such statements.

Compensation Disclosure

Power Nickel has engaged MiningStocksToday.com for an Investor Awareness and Marketing Service Agreement through the balance of 2024. We are compensated $150,000 USD to create content for use in social media campaigns and actively support the company’s messages in financial forums across the Internet. The full press release regarding this engagement can be found here.

From time to time, MiningStocksToday.com provides information about publicly traded companies that have retained our services for advertising, branding, marketing, analytics, and news distribution. Compensation may create an actual or potential conflict of interest, which should be considered by all readers. Please be aware that we may buy or sell securities of the companies mentioned on this website at any time, creating a potential conflict of interest.

Contact Us

If you have any questions or concerns about this Disclaimer, please contact us at [email protected].

MiningStocksToday.com brings you highly qualified reports in the Mining Sector with Engaging courses and video series content, podcast and much more.